Avibra: Well-Being & Benefits Hack 2.09 + Redeem Codes

Earn rewards toward insurance

Developer: Avibra Inc

Category: Health & Fitness

Price: Free

Version: 2.09

ID: com.avibra.apple

Screenshots

Description

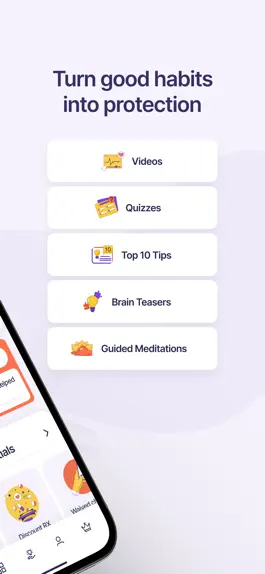

Avibra is the #1-rated insurance, finance, and well-being app that turns good habits and positive steps into insurance coverage. Each time you open our free app to read wellness tips, take a quiz, watch videos or listen to meditations, your insurance coverage grows—at no cost to you. Plus, you’ll improve your health, finances, career, relationships and community in the process.

Earn $15,000 of insurance by engaging with our app

Get weekly notifications about new content you can use and apply in order to build your insurance coverage without spending a dime. This content includes:

Guided Meditations—boost your mental and physical health.

Quizzes—make learning fun while you improve your well-being.

Videos—get inspired, plus learn more about health, finances, and work.

Brain Workouts—strengthen your brain activity and improve memory.

Gratitude Journal—re-discover what you’re grateful for.

10 Tips—improve your health, relationships and finances.

Avibra Yoga Studio—bring calm, peace, and balance to your life.

Relaxation Music—ease everyday stress and anxiety.

Bonus: Also turn your daily activities from your wearables into rewards (think Fitbit, Apple Health, Google Fit).

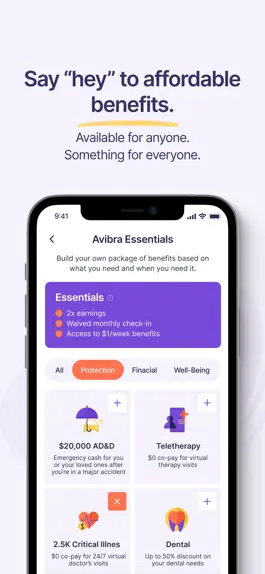

The Dollar Benefits Store

Welcome to our Dollar Benefits Store, where you can buy peace of mind for just $1/week. Purchase one benefit or several—just pay $1/week for each one you choose.

Accident Medical Benefits: Your accident medical benefit helps protect you from those high hospital bills following a covered accident such as a broken bone, concussion or burn.

Accidental Death & Dismemberment (AD&D) Benefits: Provides a benefit payment to you or your beneficiaries if you become disabled or die in a fatal accident.

Telemedicine: Unlimited 24/7 virtual visits, 365 days a year. Telemedicine doctors can provide treatment and advice for allergies, sports injuries, skin inflammations and more.

Teletherapy: Online therapy available 7 days a week. Teletherapy counselors can provide treatment for conditions like depression, stress, eating disorders, addiction, relationship problems, anxiety, grief and more.

Life Insurance: Paid out in a single lump sum to your beneficiary upon your death, life insurance protects your loved ones when you’re gone. The money is commonly used for funeral costs, medical bills and day-to-day bills.

Cell Phone Protection: For damage (including water damage) and theft.

Risk Advisor: To monitor your risks in life, your Risk Advisor includes myRadar, myDwelling, myHealth and myRide. Each feature allows you to check for common everyday risks. The Risk Advisor uses information about your location, real-time driving habits and more to help you live smarter and safer.

Critical Illness: This benefit covers cancer, heart attack, stroke, and renal failure. The fixed lump-sum cash benefit can be used to help pay out-of-pocket medical expenses like deductibles and co-pays, or non-medical expenses like grocery delivery, childcare, and more.

Roadside Assistance: For towing, emergency tire changes, lockout, battery and fuel delivery service.

Our commitment to you

Avibra is a socially-driven company at its core, and we give back to the community on an ongoing basis. Avibra works with TIST to plant a tree each month for active users, donates regularly to important social causes, and helps you anonymously protect another family in a different state each week when you stay active in the app.

Plus, enjoy myShield for additional insurance options

Find other affordable insurance plans available for purchase in-app, including home insurance, auto insurance, renters insurance, and pet insurance.

We partner with reputable sources like Hippo Insurance, ASPCA, MSI and Matic.

Live A VIBRAnt life with Avibra and enjoy peace of mind you can afford.

Download the app now.

By downloading and using Avibra, you agree to our current Terms of Use (https://www.avibra.com/Avibra_TermsofService.pdf) and Privacy Policy (https://www.avibra.com/Avibra_PrivacyPolicy.pdf)

Earn $15,000 of insurance by engaging with our app

Get weekly notifications about new content you can use and apply in order to build your insurance coverage without spending a dime. This content includes:

Guided Meditations—boost your mental and physical health.

Quizzes—make learning fun while you improve your well-being.

Videos—get inspired, plus learn more about health, finances, and work.

Brain Workouts—strengthen your brain activity and improve memory.

Gratitude Journal—re-discover what you’re grateful for.

10 Tips—improve your health, relationships and finances.

Avibra Yoga Studio—bring calm, peace, and balance to your life.

Relaxation Music—ease everyday stress and anxiety.

Bonus: Also turn your daily activities from your wearables into rewards (think Fitbit, Apple Health, Google Fit).

The Dollar Benefits Store

Welcome to our Dollar Benefits Store, where you can buy peace of mind for just $1/week. Purchase one benefit or several—just pay $1/week for each one you choose.

Accident Medical Benefits: Your accident medical benefit helps protect you from those high hospital bills following a covered accident such as a broken bone, concussion or burn.

Accidental Death & Dismemberment (AD&D) Benefits: Provides a benefit payment to you or your beneficiaries if you become disabled or die in a fatal accident.

Telemedicine: Unlimited 24/7 virtual visits, 365 days a year. Telemedicine doctors can provide treatment and advice for allergies, sports injuries, skin inflammations and more.

Teletherapy: Online therapy available 7 days a week. Teletherapy counselors can provide treatment for conditions like depression, stress, eating disorders, addiction, relationship problems, anxiety, grief and more.

Life Insurance: Paid out in a single lump sum to your beneficiary upon your death, life insurance protects your loved ones when you’re gone. The money is commonly used for funeral costs, medical bills and day-to-day bills.

Cell Phone Protection: For damage (including water damage) and theft.

Risk Advisor: To monitor your risks in life, your Risk Advisor includes myRadar, myDwelling, myHealth and myRide. Each feature allows you to check for common everyday risks. The Risk Advisor uses information about your location, real-time driving habits and more to help you live smarter and safer.

Critical Illness: This benefit covers cancer, heart attack, stroke, and renal failure. The fixed lump-sum cash benefit can be used to help pay out-of-pocket medical expenses like deductibles and co-pays, or non-medical expenses like grocery delivery, childcare, and more.

Roadside Assistance: For towing, emergency tire changes, lockout, battery and fuel delivery service.

Our commitment to you

Avibra is a socially-driven company at its core, and we give back to the community on an ongoing basis. Avibra works with TIST to plant a tree each month for active users, donates regularly to important social causes, and helps you anonymously protect another family in a different state each week when you stay active in the app.

Plus, enjoy myShield for additional insurance options

Find other affordable insurance plans available for purchase in-app, including home insurance, auto insurance, renters insurance, and pet insurance.

We partner with reputable sources like Hippo Insurance, ASPCA, MSI and Matic.

Live A VIBRAnt life with Avibra and enjoy peace of mind you can afford.

Download the app now.

By downloading and using Avibra, you agree to our current Terms of Use (https://www.avibra.com/Avibra_TermsofService.pdf) and Privacy Policy (https://www.avibra.com/Avibra_PrivacyPolicy.pdf)

Version history

2.09

2023-06-18

Bug Fixes.

2.08

2023-05-08

Bug Fixes.

2.07

2023-04-28

Check out our latest upgrades to make your Avibra experience even better.

Bug Fixes.

Bug Fixes.

2.05

2023-03-12

Check out our latest upgrades to make your Avibra experience even better.

Bug Fixes.

Bug Fixes.

2.04

2023-02-15

Check out our latest upgrades to make your Avibra experience even better.

Bug Fixes.

Bug Fixes.

2.03

2023-01-19

Check out our latest upgrades to make your Avibra experience even better.

Bug Fixes and

Your Active Benefits section has been updated.

Bug Fixes and

Your Active Benefits section has been updated.

2.02

2023-01-06

Check out our latest upgrades to make your Avibra experience even better.

We've moved Marketplace to its own page

Your Active Benefits section has been updated

We've moved Marketplace to its own page

Your Active Benefits section has been updated

2.00

2022-12-14

Bug fixes to improve your experience

1.99

2022-11-30

Your Active Benefits are now at the top of your homepage for easy access.

And, as always, bug fixes to improve your experience

And, as always, bug fixes to improve your experience

1.98

2022-11-15

Check out our latest upgrades to make your Avibra experience even better

1.97

2022-11-08

Check out our latest upgrades to make your Avibra experience even better

1.96

2022-11-03

Check out our latest upgrades to make your Avibra experience even better

1.95

2022-10-27

Check out our latest upgrades to make your Avibra experience even better

1.94

2022-10-21

Check out our latest upgrades to make your Avibra experience even better

1.92

2022-09-23

Check out our latest upgrades to make your Avibra experience even better

1.91

2022-09-14

Check out our latest upgrades to make your Avibra experience even better

1.90

2022-08-31

Check out our latest upgrades to make your Avibra experience even better:

-Chiropractic Benefits

-Alternative Medicine Benefits

-On-Demand Fitness & Nutrition

All available now in the Dollar Benefits Store

-Chiropractic Benefits

-Alternative Medicine Benefits

-On-Demand Fitness & Nutrition

All available now in the Dollar Benefits Store

1.89

2022-07-22

We've worked on our UI to make it easy to tap on benefits and read details.

And, as always, we're smashing bugs to make the experience the best we can for you.

And, as always, we're smashing bugs to make the experience the best we can for you.

1.88

2022-06-17

We've worked on our UI to make it easy to tap on benefits and read details.

And, as always, we're smashing bugs to make the experience the best we can for you.

And, as always, we're smashing bugs to make the experience the best we can for you.

1.87

2022-06-01

We've worked on our UI to make it easy to tap on benefits and read details.

And, as always, we're smashing bugs to make the experience the best we can for you.

And, as always, we're smashing bugs to make the experience the best we can for you.

1.86

2022-05-13

We've worked on our UI to make it easy to tap on benefits and read details.

Our newest feature, your monthly social contribution, lets you plant trees or help families with just the tap of a button.

And, as always, we're smashing bugs to make the experience the best we can for you.

Our newest feature, your monthly social contribution, lets you plant trees or help families with just the tap of a button.

And, as always, we're smashing bugs to make the experience the best we can for you.

1.85

2022-04-26

We're introducing a new membership renewal process for our free members! Every month, you can choose to help plant a tree or help support a family in need. It's free for you, all you'll need to do is tap a button right on the home screen to keep your membership–including your no-cost insurance and new well-being content–active. And, as always, we've included a few enhancements to make your experience in the app a bit easier.

1.83

2022-04-07

Check out our latest upgrades to make your Avibra experience even better:

-A newly redesigned Dollar Benefits Store to make selecting benefits clearer

-New well-being content to help you live A VIBRAnt life

-A newly redesigned Dollar Benefits Store to make selecting benefits clearer

-New well-being content to help you live A VIBRAnt life

1.82

2022-03-20

Check out our latest upgrades to make your Avibra experience even better:

-A newly redesigned Dollar Benefits Store to make selecting benefits clearer

-A new payment page to uncomplicate your payment options

-New well-being content to help you live A VIBRAnt life

And, as always, bug fixes to bring you the best app we can

-A newly redesigned Dollar Benefits Store to make selecting benefits clearer

-A new payment page to uncomplicate your payment options

-New well-being content to help you live A VIBRAnt life

And, as always, bug fixes to bring you the best app we can

1.81

2022-03-01

This update includes bug fixes and updates. New content is added, please go and enjoy more meditation, quizzes, articles, yoga and more!

Ways to hack Avibra: Well-Being & Benefits

- Redeem codes (Get the Redeem codes)

Download hacked APK

Download Avibra: Well-Being & Benefits MOD APK

Request a Hack

Ratings

4.9 out of 5

3 885 Ratings

Reviews

🌻🤪,

New to app and life insurance

As far as I’ve seen this is Really cool way to earn yourself some life insurance for individuals like myself that cannot afford life insurance this is a life saver. I have been worrying for years now about leaving here and my children having to pay my burial expenses and my lifetime debt that I wasn’t able to take care of. So if in fact when I pass my kids are able to get this life insurance claim to help them pay for my burial and all this apl will be a wonderful wonderful thing. I gave 5 starts because everything so far has been just that 5 stars very easy to use very easy to navigate very good at communicating when you need to do something to earn extra insurance bucks on your plan yeah this app is very very nice thanks AVIBRA

+TheGinger+,

The real deal

I found Avibra through another app and even though I figured it was too good to be true, I decided to download it anyway. And I’m so glad I did. First, let me start by saying this is a legit company and they offer legit policies—as long as you’re willing to work for it. Nothing big, you can take quizzes and watch short videos to earn money to build your policy. They email you at the beginning of every week as a reminder to keep doing your part so they can keep providing their part. The only thing I don’t like about it is that the policy ends at age 54. It’s just a small life insurance policy with the opportunity to purchase more insurance or other services as add-ons, many for $1 a week, but it’s nice to have a little cushion for my family if the unexpected happens. Of course, it would be nicer if I didn’t have to die before I’m 54 for it to be of any benefit to them, but still.

All in all, it’s a great app with a simple interface, and the company and their services are the real deal if you’re younger than 54.

All in all, it’s a great app with a simple interface, and the company and their services are the real deal if you’re younger than 54.

InfosecAustin,

Unusable app in my experience

When initially downloading this, I initially couldn’t even create an account because it kept sliding the UI off of my screen after filling in password fields. I had to download this on my iPad, create an account, and then proceed to delete it and sign back in to my phone after downloading again. Finally after all of that, I gave them the benefit of the doubt and thought this is just a fluke, and then I paid for my $2/wk subscription. I was then greeted with yet another field which they were asking for my address (even though I had never bought a physical product), and now I can’t even type in my address within the field.

It would help if this company got with the times and allowed their users to update information online and not just through an app… but that would just be too practical for them I suppose. I emailed their team to hopefully fix this and add my address so I can use the services I’m paying for but we will see.

It would help if this company got with the times and allowed their users to update information online and not just through an app… but that would just be too practical for them I suppose. I emailed their team to hopefully fix this and add my address so I can use the services I’m paying for but we will see.

lessskeptical,

I hope this app will be there for me

The information alone from this app is worth checking it out. Everything is nicely laid out! I had an easy time exploring healthier habits and ways of being. I hope the app also has my back if my family or I ever needs the benefits earned and purchased.

App works great. The most interesting part is the social outreach Avibra claims to provide. I’m a big fan of transparency. A video of trees being planted thanks to Avibra and its users would be really cool, or maybe information provided to members who want to get more directly involved in projects?

Thanks for a pleasant opportunity to help everyone to do some good for themselves and others with some spare time 😊

App works great. The most interesting part is the social outreach Avibra claims to provide. I’m a big fan of transparency. A video of trees being planted thanks to Avibra and its users would be really cool, or maybe information provided to members who want to get more directly involved in projects?

Thanks for a pleasant opportunity to help everyone to do some good for themselves and others with some spare time 😊

Lillies82268,

I Love It

I am in the middle of a divorce with a man whom basically controlled all things, but particularly finances. I’ve never been able to afford or have life insurance. This is the first time. You made it so easy, I can afford it, you offer a lot of other benefits, and I finally feel like I am making one good financial decision on my own. Thank you. Also, as a gig worker (DoorDash) we don’t have many benefits as we are contractors. Thus, we are essentially small business owners. A lot of people don’t understand how this job works, but what I can say is that offering any type of benefit makes the job even more appealing to single moms or others that work gig jobs to make ends meet.

micaroni hold the bologna,

Awesome app

So far I’ve had nothing but positive outcome on this app fortunately I’m not dead or dying momentarily so I assume all the legality is up to par. But the benefits you receive from this app is amazing when they say u can get the core plan for free they mean absolutely free ur work on the app determines how much coverage u ultimately have, it also has third party provider where you can get discounted plans for other areas of coverage including pet insurance house/renter insurance etc. I don’t ever write reviews on apps but this one rlly deserves the recognition and more ppl need to know about this awesome opportunity in this time of chaos in the world right now and ppl who may not have that extra money to spare

Morgon O'Kelley,

Shady billing practices

Purchased year long membership and year long subscription for benefits from the dollar store and then a few weeks later decided to add weekly subscription for a couple other things. Not really on the lookout for a couples dollars a week I didn’t notice that it was not billing. They had taken the products I had already paid for and used that money towards all the benefits as a credit and now when I am getting thin and i want to trim a few bucks a month from my budget and still have the important products that i had paid in advance I cannot. Every product is weekly and I am not impressed. It’s not worth the trouble, it’s not totally transparent and it took me four engagements with support to actually get an answer about the issue. I’m canceling after I write this review and I am going looking for other venues to post it.

dbunny30,

Be a small change in America

I love this so I’m helping to be a small change in someone else’s life that I don’t even know with also increasing my own benefits for myself…the win - win is great and I respect and like this very much in that they fight for helping to keep the citizens safe and land of my country healthy continue and I’m in that fight. I feel rejuvenated each month knowing my choice benefits someone or something every time I make the decision to renew ❤️👏🏽👏🏽👏🏽♉️

jennie grzy,

Most helpful app ever!

Avibra has been awesome so far between being able to help others (which is a passion of mine!) and help myself and my kids future they have taken things to the next level! I love all the options you can add so you build plans that work for your life! I’veeven learned a ton when doing the activities and actually utilizing the app. It really is the first one like this that hits home for me!!

EmpireCherry,

Awesome insurance!

Words can not express how grateful I am for finding this app! I didn’t have life insurance until now. I don’t have to even pay for it unless I choose extras. I just login and take quizzes and watch videos about better wellness, and Bam, I earn more money to put towards my life insurance plan for when my loved ones need it most. Many blessings to Avibra, and to you all!