FI Toolkit Hack 1.4 + Redeem Codes

Finance & Retirement Planner

Developer: Steve Welch

Category: Finance

Price: Free

Version: 1.4

ID: DBC.FinanceWiz

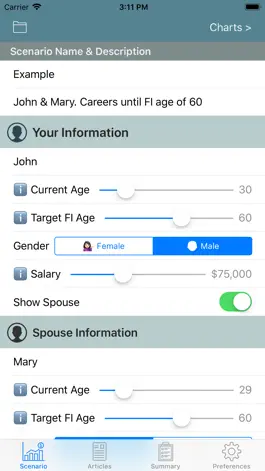

Screenshots

Description

FI Toolkit is an app to assist with the pursuit of greater financial health and Financial Independence. The app calculates and plots net-worth that reflects your current financial status and projected cash flows. The app determines when Financially Independence could be achieved and how long your net-worth will last into retirement.

Features:

• Convenient input “sliders” for finance data entry

• Informative articles about finance and Financial Independence

• Entries for Cash, Portfolio (stocks), Tax Deferred, and Tax Free accounts

• Social Security inputs for yourself and spouse

• Multiple scenarios to explore alternate financial directions

• Detailed income and expense entries

• Instant calculation and display of results (plot & spreadsheet formats)

• Summary of the scenario and the computed results

Also:

• Considers inflation factors

• Makes allowances for an emergency fund

• Determines contributions to retirement accounts

• Compounds account balances

• Estimates Federal and State taxes

• Determine distributions for expenses during retirement

• Computes Required Minimum Distributions (RMDs)

The app provides login security features (including FaceID) and synchronizes with your iPhone, iPad, and Macintosh devices. Your information is private to you and is not shared with anyone. The app is also ad-free, requires no subscription, and does not affiliate with any financial institutions selling products or services.

Features:

• Convenient input “sliders” for finance data entry

• Informative articles about finance and Financial Independence

• Entries for Cash, Portfolio (stocks), Tax Deferred, and Tax Free accounts

• Social Security inputs for yourself and spouse

• Multiple scenarios to explore alternate financial directions

• Detailed income and expense entries

• Instant calculation and display of results (plot & spreadsheet formats)

• Summary of the scenario and the computed results

Also:

• Considers inflation factors

• Makes allowances for an emergency fund

• Determines contributions to retirement accounts

• Compounds account balances

• Estimates Federal and State taxes

• Determine distributions for expenses during retirement

• Computes Required Minimum Distributions (RMDs)

The app provides login security features (including FaceID) and synchronizes with your iPhone, iPad, and Macintosh devices. Your information is private to you and is not shared with anyone. The app is also ad-free, requires no subscription, and does not affiliate with any financial institutions selling products or services.

Version history

1.4

2023-02-06

Updated Federal and State tax brackets and rates.

1.3

2021-12-25

Updated Federal and State tax brackets and rates. Updated Required Minimum Distribution (RMD) calculations. Misc fixes and improvements.

1.2.1

2020-11-20

Now supports Apple Silicon and Intel Macs.

1.2

2020-11-19

Now supports Apple Silicon and Intel Macs.

1.1

2020-02-05

Federal tax calculations were updated to reflect the 2020 year tax code. State income tax calculations were developed and added to the Spreadsheet methodology and Account Balance chart. The Required-Minimum-Distribution (RMD) methodology was revised to reflect the new SECURE act rules for distributions at 72 years old starting in 2020. Improved automated 401(k), IRA, and ROTH IRA contributions and added matching employer 401(k) contribution preference. The iOS Dark Mode capabilities were enabled throughout the app. Finally, miscellaneous improvements and bug fixes were incorporated.

1.0

2019-05-15

Ways to hack FI Toolkit

- Redeem codes (Get the Redeem codes)

Download hacked APK

Download FI Toolkit MOD APK

Request a Hack

Reviews

orthodez,

DO not purchase until adjustments made

Cannot do any projections with a salary above $200k. Cannot contact developer. Useless if your income exceeds$200,000/yr

BG Golfer,

Doesn't seem accurate

I'm a pretty savvy financial person with impeccable records and knowledge of using all sorts of different retirement planners. Entry is easy with your app...but the calculations seem wacky.

For example, in your Example Portfolio, you have $5,000 in Cash Savings Account entered on the left side. Yet your spreadsheet for the current year shows $20,000. Where in the world does this number come from? Where does the other $15,000 come from? Shouldn't all current entries in the left side then show in the current year on the spreadsheet?

Other amounts entered in the Savings Accounts areas (Portfolio, Tax Deferred and Tax Free) also have inaccurate amounts in the current year.

Even taking into account the rate of inflation and/or the Growth or Rate of Return does not give me numbers even close to whats displayed in the app.

Isn't your app supposed to calculate from TODAY and then into the future? Or does it mysteriously start at some strange unknown previous year? There's no explanation available.

These miscalculations throw off my complete retirement analysis and the accompanying graph.

Additionally, it would be nice if your "App Support" actually had a way to communicate directly with you or through your lame website so questions about this app could be explained and/or resolved.

So...oh wise app creator. Why do my all Savings Accounts amounts differ in what I have entered and what is displayed in the current spreadsheet year and thus calulated into the future?

If this is explained properly (ie I'm missing something) or if you correct the spreadsheet and graph due to this inaccuray, then I'll amend my review to a more favorable one.

Until them, I'm baffled where you get your basis for your calculations from.

For example, in your Example Portfolio, you have $5,000 in Cash Savings Account entered on the left side. Yet your spreadsheet for the current year shows $20,000. Where in the world does this number come from? Where does the other $15,000 come from? Shouldn't all current entries in the left side then show in the current year on the spreadsheet?

Other amounts entered in the Savings Accounts areas (Portfolio, Tax Deferred and Tax Free) also have inaccurate amounts in the current year.

Even taking into account the rate of inflation and/or the Growth or Rate of Return does not give me numbers even close to whats displayed in the app.

Isn't your app supposed to calculate from TODAY and then into the future? Or does it mysteriously start at some strange unknown previous year? There's no explanation available.

These miscalculations throw off my complete retirement analysis and the accompanying graph.

Additionally, it would be nice if your "App Support" actually had a way to communicate directly with you or through your lame website so questions about this app could be explained and/or resolved.

So...oh wise app creator. Why do my all Savings Accounts amounts differ in what I have entered and what is displayed in the current spreadsheet year and thus calulated into the future?

If this is explained properly (ie I'm missing something) or if you correct the spreadsheet and graph due to this inaccuray, then I'll amend my review to a more favorable one.

Until them, I'm baffled where you get your basis for your calculations from.