OptionGreeks Hack 2023.05.28 + Redeem Codes

Developer: Joao Frasco

Category: Finance

Price: $4.99 (Download for free)

Version: 2023.05.28

ID: Joao.Frasco.OptionPricing

Screenshots

Description

OptionGreeks is an educational tool to help users understand option pricing. Options are derivative instruments, which can be traded on stock markets / exchanges around the world. They are derivatives in that their values and contracts are derived from the "price" of some other financial instrument (including individual shares, bonds, commodities, exchange rates, interest rates etc., or indices of these). Options come in many variants, but this app focuses on European options (only exercisable at expiry). It covers Calls and Puts, from the buyer's (long) and seller's (short) perspectives.

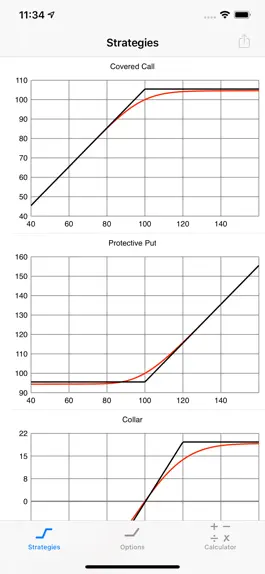

The Strategies tab includes many different option strategies (a combination of one or more options, as well as the underlying asset), so that you can see the payoff profile, price and the greeks for these strategies / combinations.

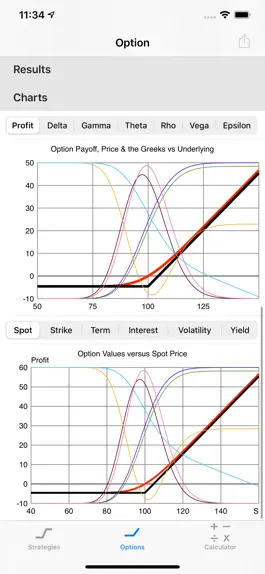

The Options tab will calculate the theoretical price of options, given the user's choice of the relevant parameters (using sliders) which include the spot price of the underlying instrument, the strike price of the option, the risk-free interest rate (discount rate), the volatility of the underlying spot price (implied volatility), the yield of the underlying instrument, and the term to maturity (or expiry) of the option (in days). It will also calculate the values of the "Greeks", which includes delta, gamma, theta, rho, vega, and epsilon. It displays all of these in charts against each of the underlying parameters (as selected by the user).

The Calculator tab will calculate all of the above using a more traditional calculator, allowing you to enter actual amounts precisely (instead of using sliders). It also provides a graphical representation dynamically changing as the parameters change.

The Strategies tab includes many different option strategies (a combination of one or more options, as well as the underlying asset), so that you can see the payoff profile, price and the greeks for these strategies / combinations.

The Options tab will calculate the theoretical price of options, given the user's choice of the relevant parameters (using sliders) which include the spot price of the underlying instrument, the strike price of the option, the risk-free interest rate (discount rate), the volatility of the underlying spot price (implied volatility), the yield of the underlying instrument, and the term to maturity (or expiry) of the option (in days). It will also calculate the values of the "Greeks", which includes delta, gamma, theta, rho, vega, and epsilon. It displays all of these in charts against each of the underlying parameters (as selected by the user).

The Calculator tab will calculate all of the above using a more traditional calculator, allowing you to enter actual amounts precisely (instead of using sliders). It also provides a graphical representation dynamically changing as the parameters change.

Version history

2023.05.28

2023-05-28

Updated to iOS 16.4.

2022.10.01

2022-10-04

Updated to iOS 16!

2021.09.30

2021-09-30

Updated to iOS 15.0!

2021.07.19

2021-07-20

Smashed some bugs with the user interface!

2021.01.04

2021-01-05

Updated to iOS 14.3!

2020.09.21

2020-09-21

Updated to iOS 14!

1.5

2020-02-07

Updated to iOS 13.2.

1.4

2019-10-17

Updated to iOS 13 and enabled Dark Mode! Made many changes to the calculator to enable saving of multiple options to create a strategy (including physical)!

1.3

2019-08-13

Mainly bug fixes! Change to the calculator look and feel.

1.2

2019-08-12

Added a brand new calculator tab that allows you to precisely calculate the theoretical option price and the greeks (instead of using sliders).

Also changed yield to allow negative numbers, and fixed some bugs.

Also changed yield to allow negative numbers, and fixed some bugs.

1.0

2019-02-08

Ways to hack OptionGreeks

- Redeem codes (Get the Redeem codes)

Download hacked APK

Download OptionGreeks MOD APK

Request a Hack

Ratings

2.3 out of 5

3 Ratings

Reviews

!(O_O)?,

Why underlying price is maximum only 200?

There’s no explanation about how yo use it. I’m add m confused.

dfee87,

Please have an update

I just purchased seemed cool but buggy.