Teachoo Hack 1.5 + Redeem Codes

Learn Maths, GST, Accounts Tax

Developer: Mishmash Education Services Private Limited

Category: Education

Price: Free

Version: 1.5

ID: com.teachoo.app

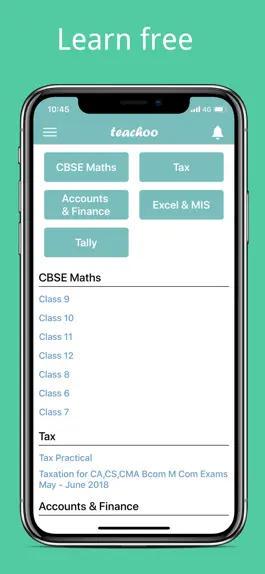

Screenshots

Description

At Teachoo, we provide material for

- School Students, for Class 6 to 12

- Accounts and Tax Professionals

- Everyone who wants to Learn English

For School Students

-------------------------

Are you in Class 6 to 12?

Then, we have NCERT Solutions for you. For both Maths and Science.

All NCERT Questions, Examples, Questions from inside the NCERT, CBSE Sample Paper, Past Year Papers... everything has been solved for you!

Accounts and Finance Professionals

------------------------------

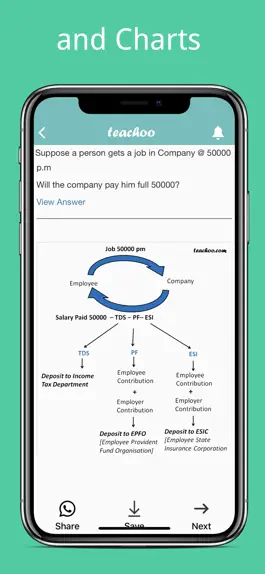

Learn Return filing of Goods and Service Tax (GST) , TDS, Income Tax, Accounts & Finance, Excel & Tally in easy language.

All taxes are regularly updated with recent changes and important amendments.You can also get free alerts or notifications for the same.

Content prepared by Charted Accountants (CA) and updated regularly.

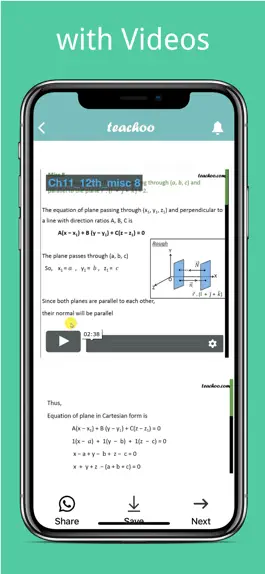

Each topic is well explained in detail with notes, videos and charts

You can also download content to view it offline without internet.

In case, you face any problem, you can ask an expert also free.

English

-----------------------

We also provide free practice for Written English, Spoken English, Vocabulary and Grammar.

Here, we have added conversations from where you can practice speaking with a partner

--------------------------

Detailed list of topics are

- Maths: Solutions of all NCERT questions, Sample Papers for CBSE Class 6, 7, 8, 9, 10, 11 and 12 with videos FREE.

- Science: NCERT solutions and Notes of Science for Class 6,7,8,9,10

- Practical Tax: TDS (Tax Deductible at Source) , Payroll, PF, ESI, GST Goods and Service Tax, Work Contract Tax

- Accounts and Finance: Basics, Routine Entries, Book Closure Entries, Balance Sheet BS Finalization, Preparing projections and budgets, Fund flow cash flow, Ratio Analysis,

- Income Tax, VAT, CST, Excise, Customs, Service Tax, Cenvat Credit,

- Basic & Advanced Excel with macros

- Tally.

You can also take our Practical Accounts Taxation Training & Efiling Course at https://www.teachoo.com/premium/

Get NCERT Solutions with videos of all chapters of Class 6 to 12. Every step explained in detail.

We also provide important questions for your exams for Class 6, 7, 8, 9, 10, 11, 12. This will be ideal for your preparation for CBSE Boards

- School Students, for Class 6 to 12

- Accounts and Tax Professionals

- Everyone who wants to Learn English

For School Students

-------------------------

Are you in Class 6 to 12?

Then, we have NCERT Solutions for you. For both Maths and Science.

All NCERT Questions, Examples, Questions from inside the NCERT, CBSE Sample Paper, Past Year Papers... everything has been solved for you!

Accounts and Finance Professionals

------------------------------

Learn Return filing of Goods and Service Tax (GST) , TDS, Income Tax, Accounts & Finance, Excel & Tally in easy language.

All taxes are regularly updated with recent changes and important amendments.You can also get free alerts or notifications for the same.

Content prepared by Charted Accountants (CA) and updated regularly.

Each topic is well explained in detail with notes, videos and charts

You can also download content to view it offline without internet.

In case, you face any problem, you can ask an expert also free.

English

-----------------------

We also provide free practice for Written English, Spoken English, Vocabulary and Grammar.

Here, we have added conversations from where you can practice speaking with a partner

--------------------------

Detailed list of topics are

- Maths: Solutions of all NCERT questions, Sample Papers for CBSE Class 6, 7, 8, 9, 10, 11 and 12 with videos FREE.

- Science: NCERT solutions and Notes of Science for Class 6,7,8,9,10

- Practical Tax: TDS (Tax Deductible at Source) , Payroll, PF, ESI, GST Goods and Service Tax, Work Contract Tax

- Accounts and Finance: Basics, Routine Entries, Book Closure Entries, Balance Sheet BS Finalization, Preparing projections and budgets, Fund flow cash flow, Ratio Analysis,

- Income Tax, VAT, CST, Excise, Customs, Service Tax, Cenvat Credit,

- Basic & Advanced Excel with macros

- Tally.

You can also take our Practical Accounts Taxation Training & Efiling Course at https://www.teachoo.com/premium/

Get NCERT Solutions with videos of all chapters of Class 6 to 12. Every step explained in detail.

We also provide important questions for your exams for Class 6, 7, 8, 9, 10, 11, 12. This will be ideal for your preparation for CBSE Boards

Version history

1.5

2022-05-20

Thank you for making this app awesome with your review comments. We hear you and we've fixed some of the suggestions posted in the app review section. Keep learning!

1.4

2020-04-21

We update the app regularly so we can make it better for you. To make sure you don't miss a thing just keep the app updated.

This version includes:

1. An improved navigation bar for enhanced user experience.

2. Added "Science" on Home quick links.

3. Added "Syllabus, previous papers, and Datesheet" under the CBSE Maths section.

4. Some major bugs and security fixes.

This version includes:

1. An improved navigation bar for enhanced user experience.

2. Added "Science" on Home quick links.

3. Added "Syllabus, previous papers, and Datesheet" under the CBSE Maths section.

4. Some major bugs and security fixes.

1.2

2019-05-14

Ways to hack Teachoo

- Redeem codes (Get the Redeem codes)

Download hacked APK

Download Teachoo MOD APK

Request a Hack

Ratings

5 out of 5

3 Ratings

Reviews

yash1299,

excellent app

i’ve used this in android phone cuz my friend referred it and i just want to ask wheather there is vector algebra in this app